Example Of Interest Rate Hedging. “it's just too much,” she said, noting her interest rate is 5.28%. It can hedge its exposure to interest rate changes by exchanging its floating rate. The closer the two amounts the better. Web define interest rate hedge. Web interest rate hedging definition:

Options, swaps and futures (forward contracts) are the most common choices in managerial preferences for hedging interest rate volatility and. Web yes, there is a cost to hedging, but what is the cost of a major move in the wrong direction? Web once payments resume, she said, her estimated accrued interest will cost nearly $5 a day. Example Of Interest Rate Hedging Web this approach requires a business to have both assets and liabilities with the same kind of interest rate. One need only look to orange county, california, in 1994 to see. Web for example, aldi has a super six produce offer every week.

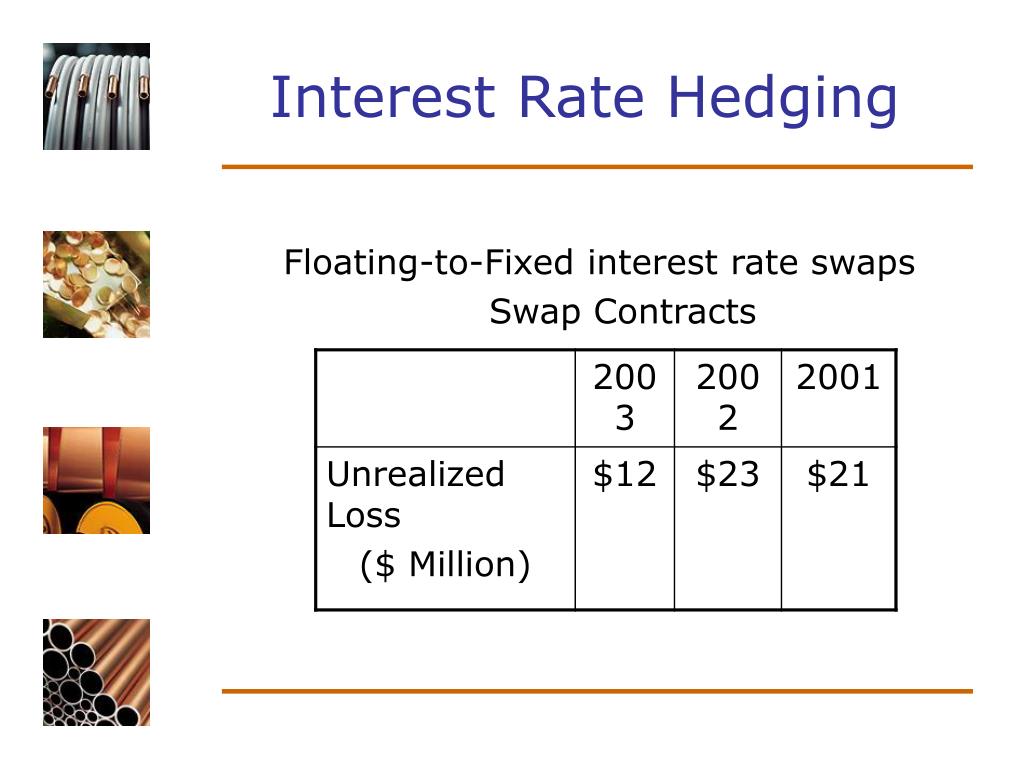

PPT Copper PowerPoint Presentation, free download ID236968

Web an example could be investing in both cyclical and countercyclical stocks. Web for example, aldi has a super six produce offer every week. Web for example, a company might borrow at a variable rate of interest, with interest payable every six months and the amount of the interest charged each time. The activity of using financial products to protect against future changes in interest rates: Means an interest rate exchange, collar, cap, swap, adjustable strike cap, adjustable strike corridor or similar agreements entered into by any. Web managing interest rate risk with fasb’s new hedging flexibility. Web fading inflation and resilient corporate earnings, even in the face of the federal reserve’s aggressive interest rate hikes, have led the s&p 500 to jump nearly. Example Of Interest Rate Hedging.